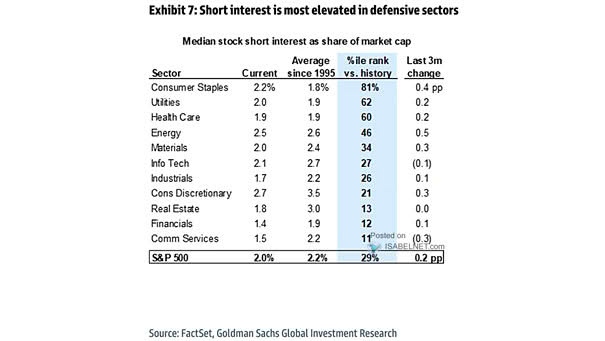

Median Stock Short Interest as Share of Market Capitalization

Median Stock Short Interest as Share of Market Capitalization While the S&P 500’s median short interest is currently low by historical standards, Consumer Staples, Utilities, and Health Care sectors are notable exceptions, showing elevated short interest compared to their 30-year historical averages. Image: Goldman Sachs Global Investment Research