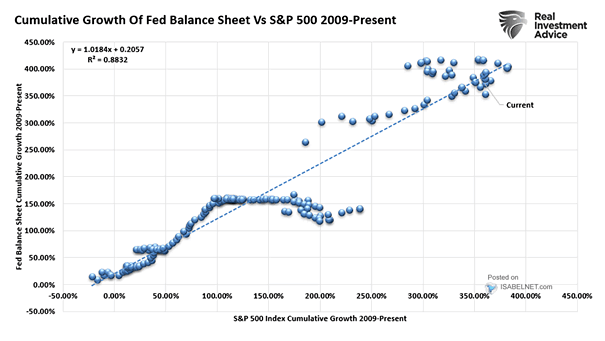

95% Correlation with the US Stock Market and an R² of 0.90 since 1970

95% Correlation with the US Stock Market and an R² of 0.90 since 1970 Our forecasting models have a fantastic 95% correlation with the US stock market on a quarterly basis since 1970 and an R² of 0.90. It means that 90 percent of the US stock market variance is predictable by the flows of data…