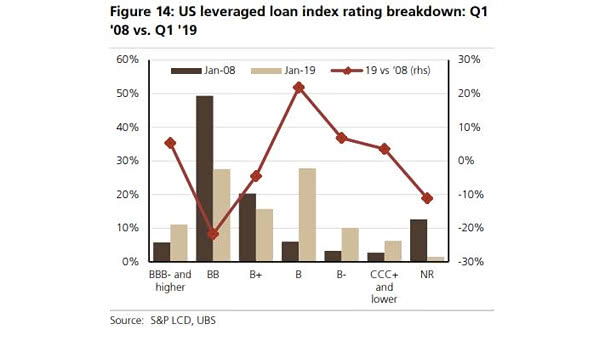

U.S. Leveraged Loan Index Rating Breakdown: 2008 vs. 2019

U.S. Leveraged Loan Index Rating Breakdown: 2008 vs. 2019 Since 2008, this chart shows that U.S. leveraged loans are getting lower ratings. Any drop in the credit ratings could also amplify the next recession. Image: Standard & Poor’s Leveraged Commentary & Data, UBS