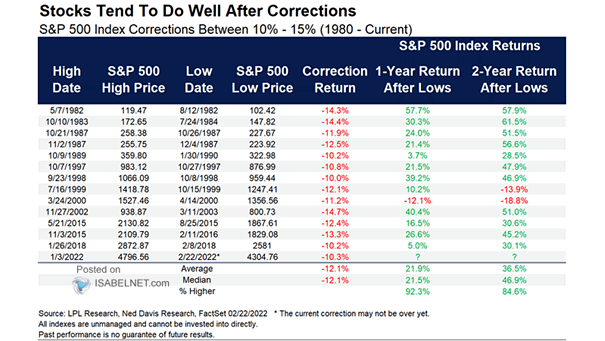

Return – S&P 500 Index Corrections of 10%-15%

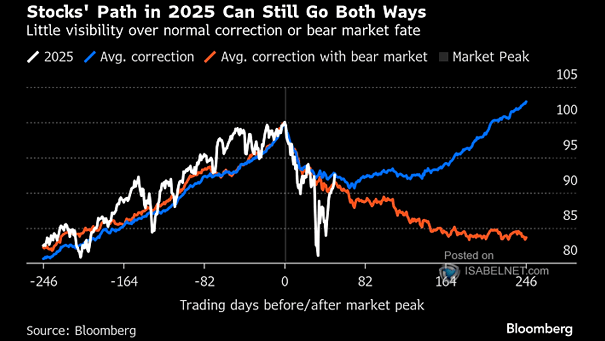

Return – S&P 500 Index Corrections of 10%-15% History shows that sharp early-year declines in the S&P 500—like those in 2009, 2020, and now 2025—often set the stage for powerful rebounds and strong year-end gains. Image: Carson Investment Research