S&P 500 EPS – Potential U.S. Tax Impact on Earnings Per Share

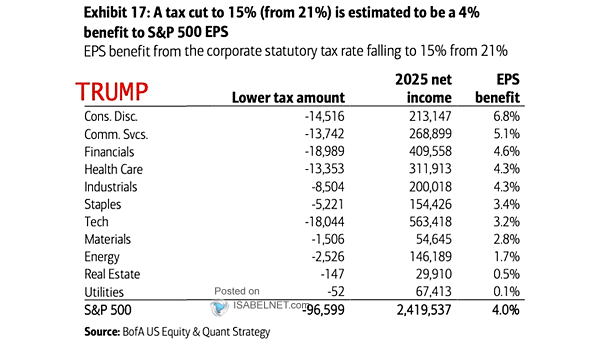

S&P 500 EPS – Potential U.S. Tax Impact on Earnings Per Share Donald Trump’s plan to cut the U.S. corporate tax rate from 21% to 15% could significantly impact S&P 500 earnings per share, potentially increasing EPS by 4% and improving profitability for many companies in the index. Image: BofA US Equity & Quant Strategy