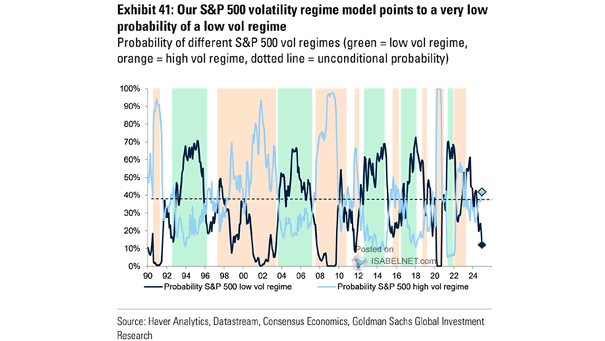

Average Probability S&P 500 Volatility Regime

Average Probability S&P 500 Volatility Regime The probability of a high S&P 500 volatility regime has increased, suggesting that elevated volatility could persist throughout 2025. Image: Goldman Sachs Global Investment Research