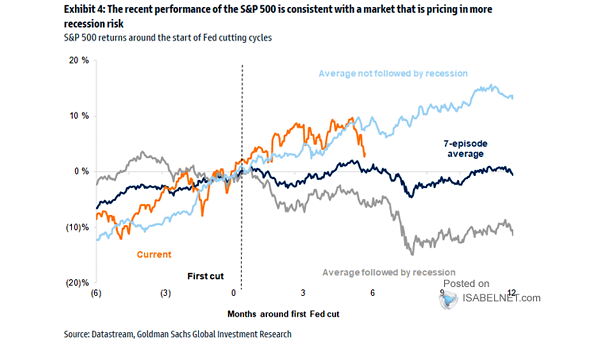

S&P 500 Return Around First Fed Cut After Being on Hold for 6+ Months

S&P 500 Return Around First Fed Cut After Being on Hold for 6+ Months Historically, U.S. stocks often deliver strong returns in the 12 months after the Fed resumes cutting rates, particularly when economic growth continues. Image: Goldman Sachs Global Investment Research