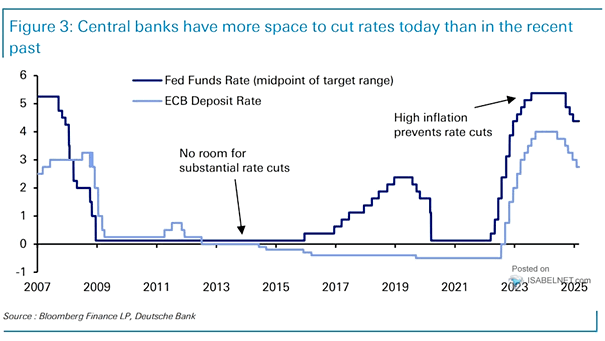

Federal Funds Rate and ECB Deposit Rate

Federal Funds Rate and ECB Deposit Rate Unlike the recent past, when inflation was high and interest rates were near zero, the Fed and ECB now have greater flexibility to cut rates if economic conditions worsen. Image: Deutsche Bank