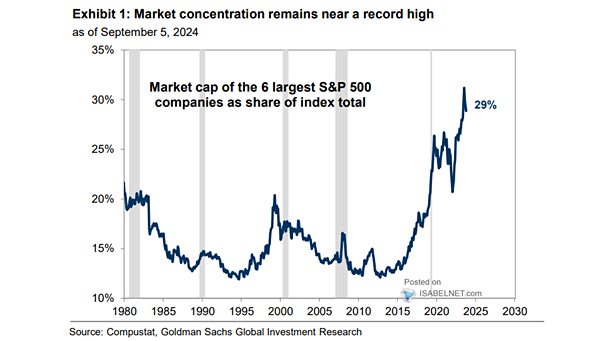

Market Capitalization of Five Largest Companies as Share of S&P 500 Total

Market Capitalization of Five Largest Companies as Share of S&P 500 Total The five largest companies account for 29% of the S&P 500’s total market capitalization, sparking discussions about diversification. Maintaining a well-diversified portfolio is crucial for effective risk management. Image: Goldman Sachs Global Investment Research