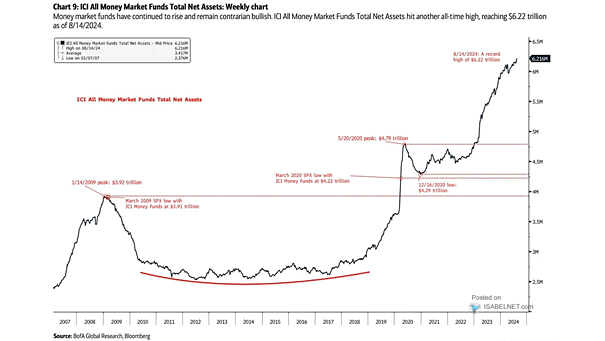

All Money Market Funds Total Net Assets

All Money Market Funds Total Net Assets Investors currently hold $6.154 trillion in money market funds, which is being interpreted as a contrarian bullish signal for the stock market. Image: BofA Global Research