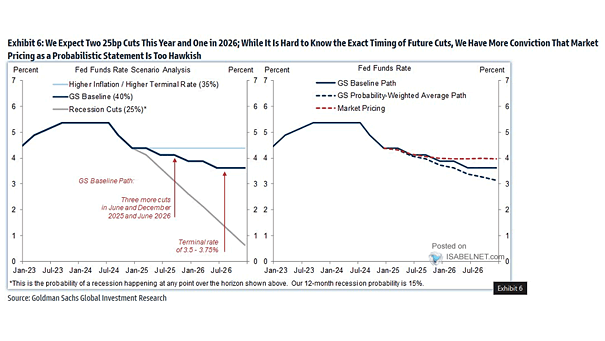

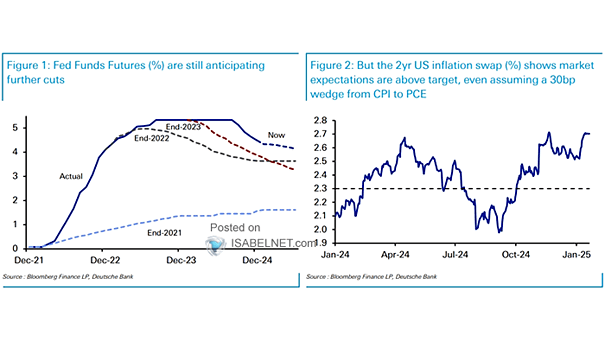

Fed Funds Rate

Fed Funds Rate Goldman Sachs expects the Fed to implement two 25 basis point rate cuts in 2025, with an additional cut projected for 2026. How will the Fed navigate potential increases in trade tariffs under the Trump administration? Image: Goldman Sachs Global Investment Research