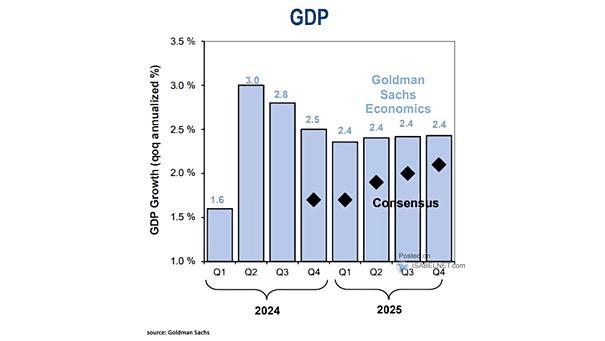

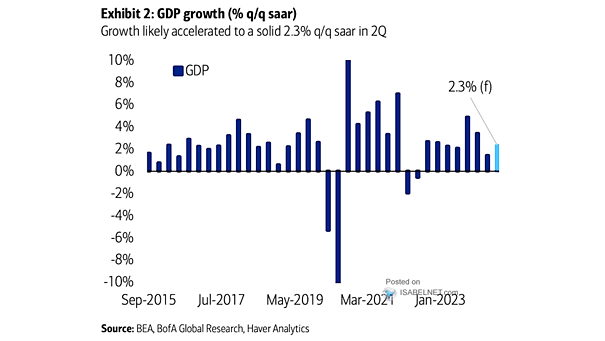

U.S. GDP Growth

U.S. GDP Growth Goldman Sachs expresses strong confidence in the U.S. economy’s resilience and anticipates a more favorable growth outlook for U.S. GDP in 2024 and 2025 compared to consensus forecasts. Image: Goldman Sachs Global Investment Research