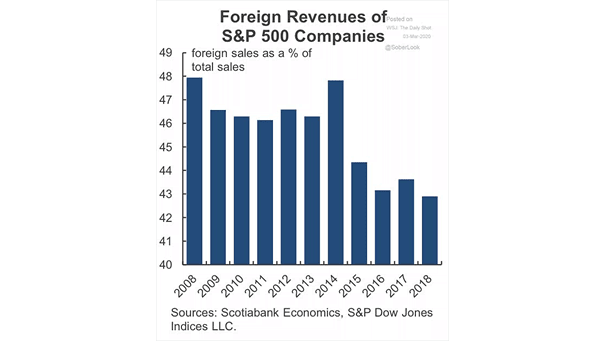

Foreign Revenues by Region for the S&P 500

Foreign Revenues of S&P 500 Companies While S&P 500 companies are broadly exposed to global markets, the majority of their sales—and thus, much of their operational and macroeconomic risk—remains tied to the U.S. economy. Image: Goldman Sachs Global Investment Research