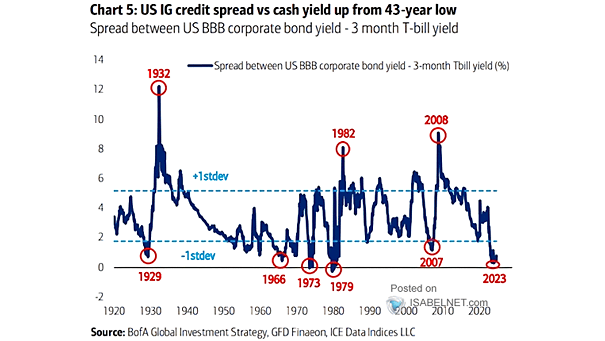

Spread Between BBB-Rated Corporate Bond Yield and 90-Day U.S. Treasury Bill Yield

Spread Between BBB-Rated Corporate Bond Yield and 90-Day U.S. Treasury Bill Yield The recent increase in the spread between IG credit yield and cash yield marks a significant shift from a 43-year low. Should investors favor U.S. Treasury bills over IG bonds? Image: BofA Global Investment Strategy