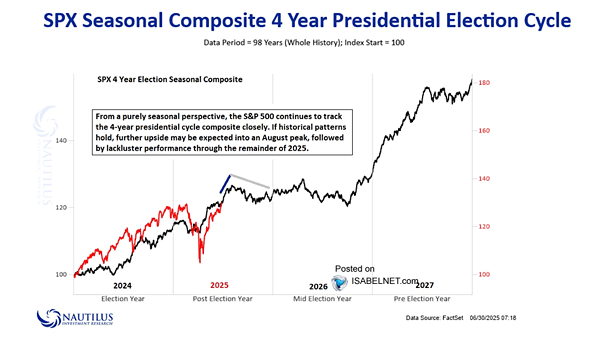

S&P 500 Seasonal Composite 4 Year Presidential Election Cycle

S&P 500 Seasonal Composite 4 Year Presidential Election Cycle The S&P 500’s behavior in 2025 continues to align with the presidential election 4-year seasonal cycle, which provides a useful framework. Image: Nautilus Research