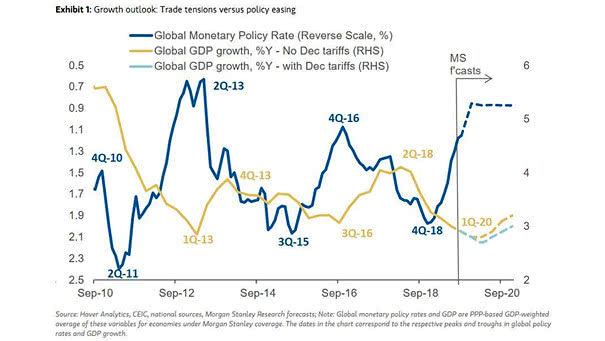

Trade Tensions Events and Average Correlation of Assets Tracking China Related Risks

Trade Tensions Events and Average Correlation of Assets Tracking China Related Risks This chart shows the risk of renewed US-China trade tensions and market pricing. Image: Goldman Sachs Global Investment Research