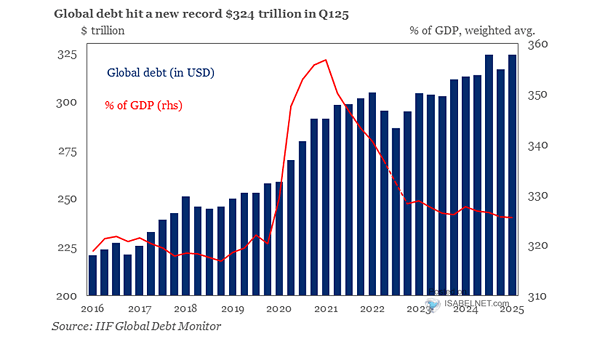

Global Debt Hits a Fresh Record

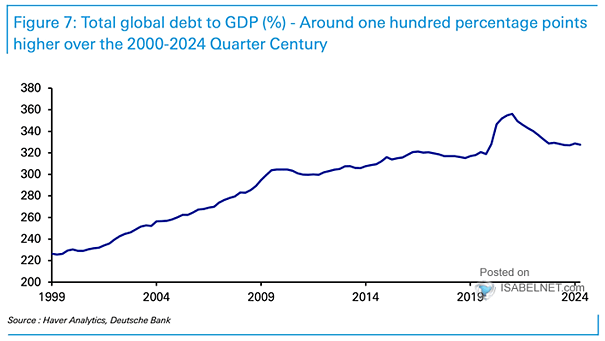

Global Debt Hits a Fresh Record While the global debt-to-GDP ratio has slightly declined, the absolute debt burden remains a major risk, requiring careful fiscal management and international cooperation to avoid financial instability. Image: International Monetary Fund