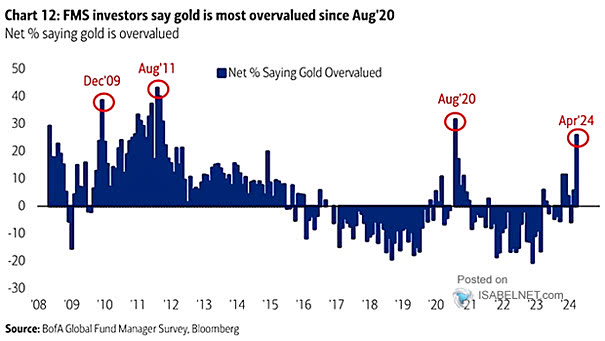

FMS Investors – Net % Saying Gold Overvalued

FMS Investors – Net % Saying Gold Overvalued According to FMS investors, gold is currently considered the most overvalued since August 2020, raising concerns about a potential market bubble. Image: BofA Global Fund Manager Survey