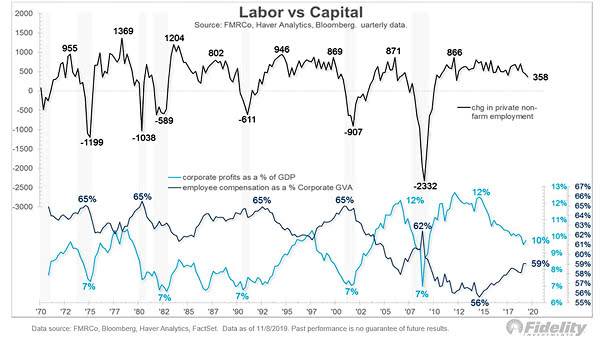

U.S. Business Cycle: Private Non-farm Employment, Corporate Profits and Employee Compensation

U.S. Business Cycle: Private Non-farm Employment, Corporate Profits and Employee Compensation This chart highlights the decline in corporate profits and rising wages, one characteristic of the late stage of the business cycle. Image: Fidelity Investments