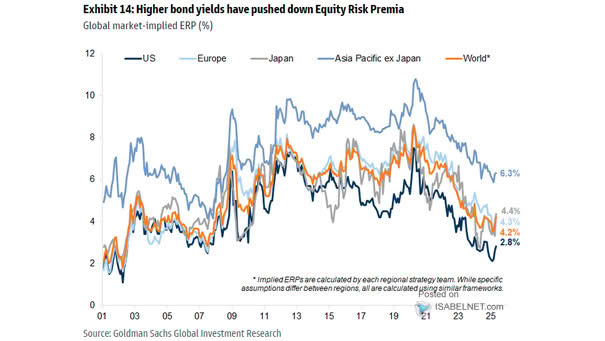

Global Market Implied Equity Risk Premiums

Global Market Implied Equity Risk Premiums Equity risk premiums are currently low, particularly in the United States, indicating a less attractive market environment where investors may not be adequately compensated for the risks associated with equity investments. Image: Goldman Sachs Global Investment Research