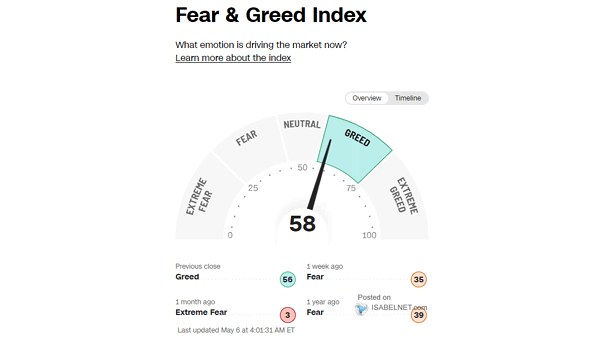

Fear & Greed Index – Investor Sentiment

Fear & Greed Index – Investor Sentiment Currently at a reading of 45, the Fear & Greed Index suggests a neutral level of market sentiment, highlighting a balance between fear and greed among investors. Image: Cable News Network