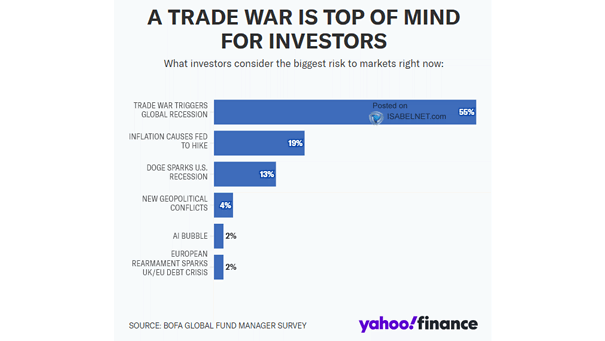

What Investors Consider the Biggest Risk to Markets Right Now

What Investors Consider the Biggest Risk to Markets Right Now The risk of a trade war triggering a global recession is a pressing concern for investors, as it threatens economic growth, financial stability, and market confidence. Image: Yahoo Finance