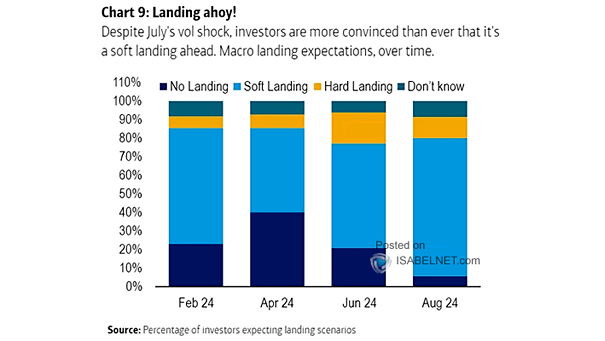

Survey – Percentage of Investors Expecting Landing Scenarios

Survey – Percentage of Investors Expecting Landing Scenarios In BofA’s August credit investor survey, 74% of investors anticipate a soft landing, reflecting a significant increase in optimism despite recent market volatility. Image: BofA Global Research