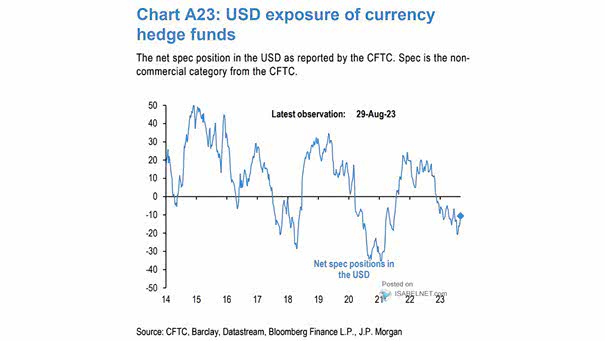

U.S. Dollar Exposure of Currency Hedge Funds

U.S. Dollar Exposure of Currency Hedge Funds Hedge funds have significantly increased their bearish bets against the U.S. dollar, reflecting widespread expectations that the dollar will weaken further against other major currencies. Image: J.P. Morgan