Active vs. Passive Fund Flows

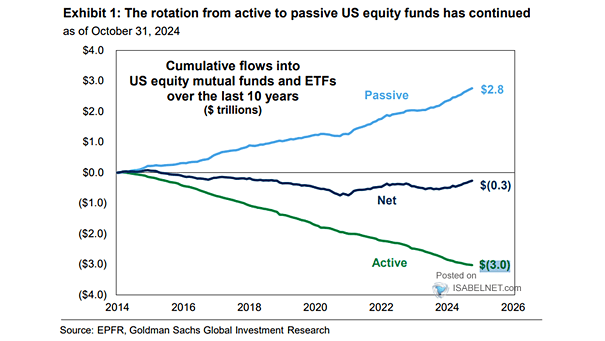

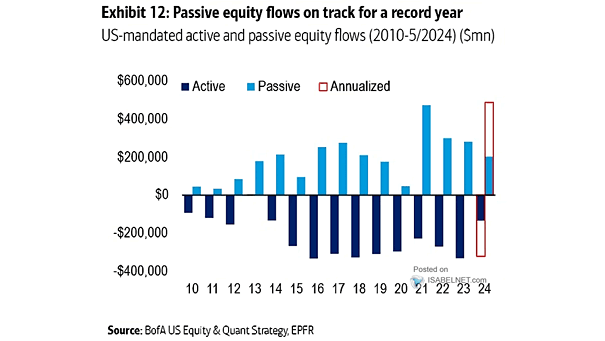

Active vs. Passive Fund Flows The trend of investors shifting from active to passive funds has accelerated significantly over the past decade, driven by cost considerations, performance outcomes, and evolving market practices. Image: Goldman Sachs Global Investment Research