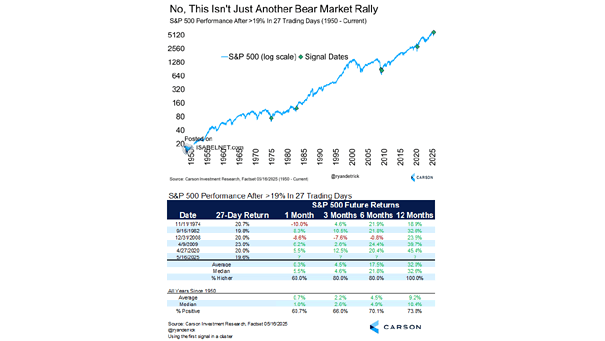

S&P 500 Performance After >19% in 27 Trading Days

S&P 500 Performance After >19% in 27 Trading Days This is more than just another bear market rally, as the S&P 500 has jumped over 19% in 27 trading days. Historically, since 1950, similar rallies have averaged a 32% gain one year later, with positive returns every time. Image: Carson Investment Research