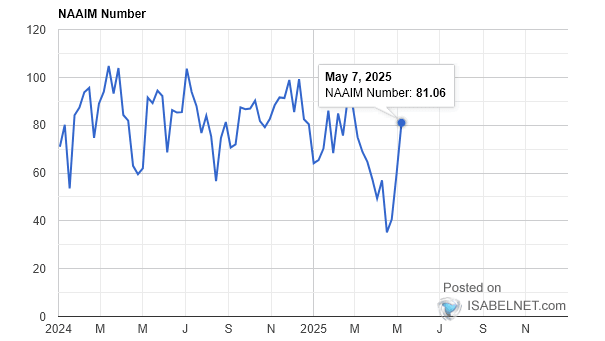

NAAIM Exposure Index – Investor Sentiment

NAAIM Exposure Index – Investor Sentiment The National Association of Active Investment Managers Exposure Index represents the two-week moving average exposure to U.S. equity markets reported by NAAIM members. The NAAIM Exposure Index at 76.70 indicates that active investment managers have still a relatively high level of exposure to the market, and remain confident for the time…