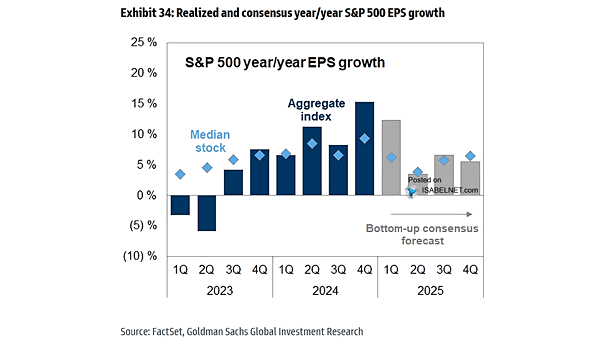

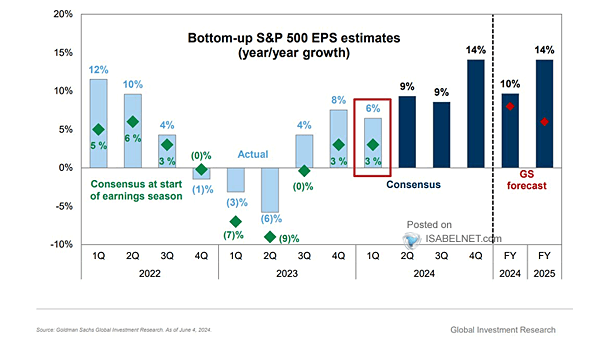

S&P 500 EPS

S&P 500 EPS While Q2 2025 is expected to see a marked deceleration in S&P 500 EPS growth to 4% year-over-year, consensus forecasts call for a rebound and robust earnings expansion in the second half of 2025. Image: Goldman Sachs Global Investment Research