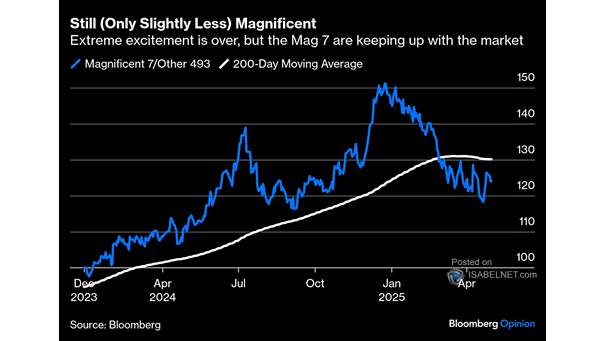

S&P 500 – Magnificent 7/Other 493 and 200-Day Moving Average

S&P 500 – Magnificent 7/Other 493 and 200-Day Moving Average The frenzy surrounding the Magnificent Seven tech stocks has faded in 2025, but these firms remain key players and are broadly keeping pace with the market, despite recent turbulence. Image: Bloomberg