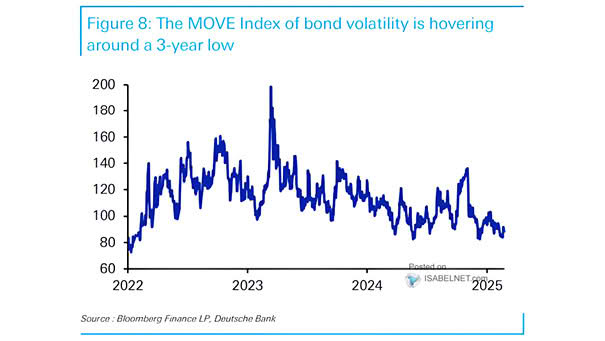

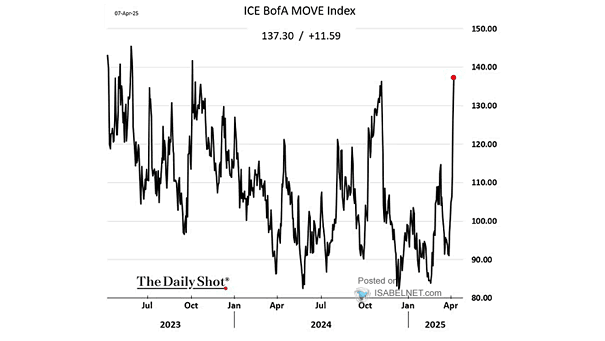

MOVE Index and Discretionary Investors Equity Positioning

MOVE Index and Discretionary Investors Equity Positioning Discretionary investors equity positioning has remained inversely correlated with U.S. rates volatility. Image: Deutsche Bank Asset Allocation