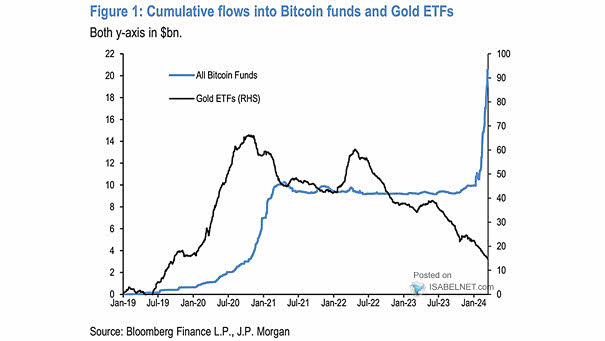

Cumulative Flows in All Bitcoin Funds and Gold ETF Holdings

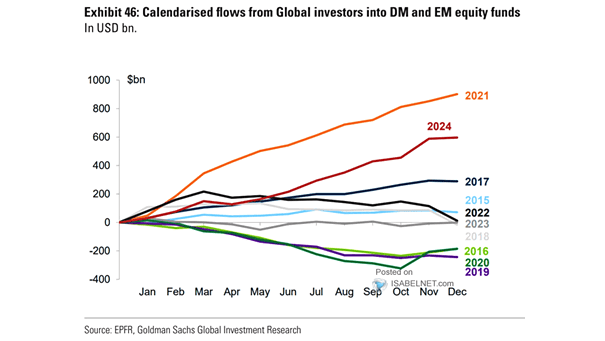

Cumulative Flows in All Bitcoin Funds and Gold ETF Holdings The past month has seen a clear preference for Bitcoin over gold among investors, driven by a shift toward riskier assets, robust technical performance, and accelerating ETF inflows into Bitcoin. Image: Goldman Sachs Global Investment Research