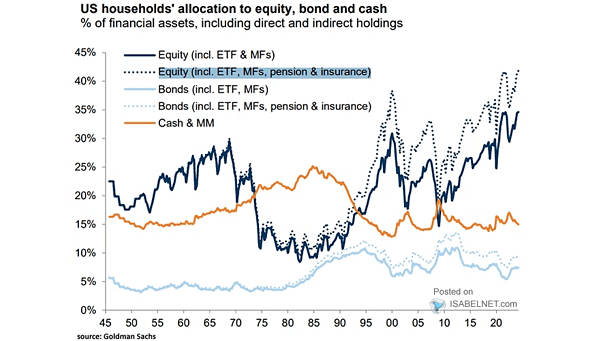

U.S. Households’ Allocation to Equity, Bond and Cash

U.S. Households’ Allocation to Equity, Bond and Cash Americans’ love for stocks has driven household equity allocations to historic highs, increasing wealth but also sparking concerns about market stability and the risks of shifting investor sentiment. Image: Goldman Sachs Global Investment Research