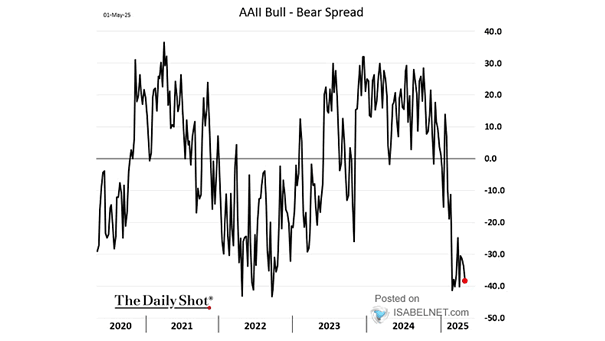

AAII U.S. Investor Sentiment Bearish Readings

AAII U.S. Investor Sentiment Bearish Readings While AAII U.S. investor pessimism has eased to a 20-week low, bearish sentiment remains modestly elevated relative to historical averages, indicating that caution lingers even as market conditions improve. Image: The Daily Shot