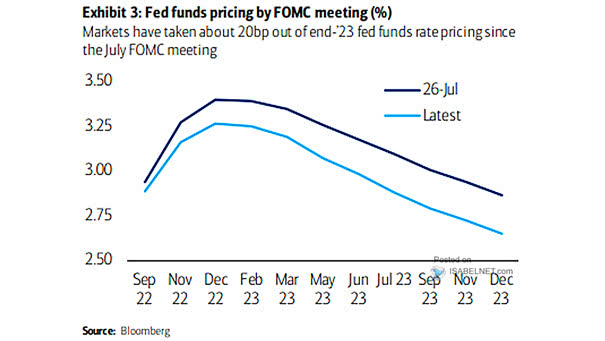

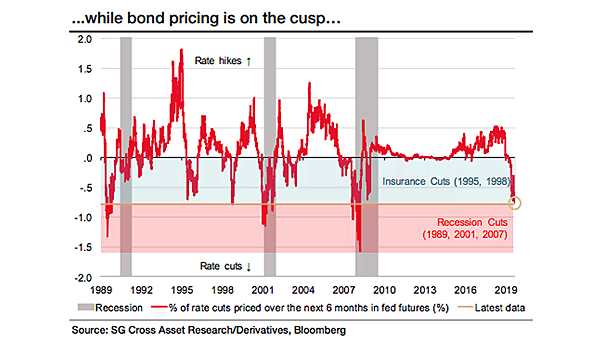

Amount of Fed Rate Cuts Priced by End of Year

Amount of Fed Rate Cuts Priced by End of Year The outlook could change quickly in response to upcoming inflation data or shifts in the economic landscape, but for now, traders are pricing in almost two rate cuts before the end of 2025. Image: Bloomberg