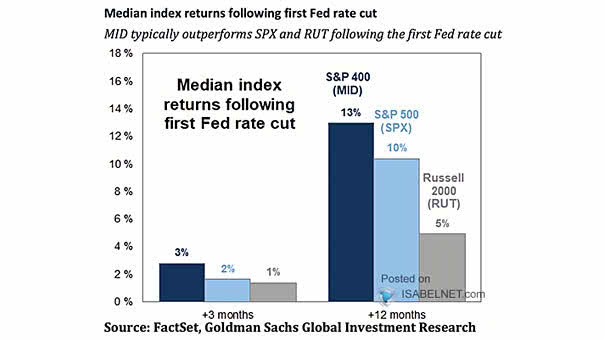

Median Index Returns Following First Fed Rate Cut

Median Index Returns Following First Fed Rate Cut Historically, midcaps have outperformed the S&P 500 and the Russell 2000 in the three and twelve months following the initial Federal Reserve rate cut. Image: Goldman Sachs Global Investment Research