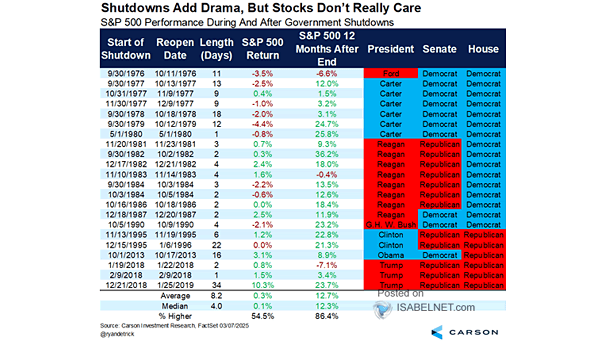

S&P 500 Performance During Government Shutdowns

S&P 500 Performance During Government Shutdowns While government shutdowns can create short-term volatility, historical data shows that the S&P 500 has gained an average of 12.7% in the 12 months after such events, with positive returns occurring 86.4% of the time. Image: Carson Investment Research