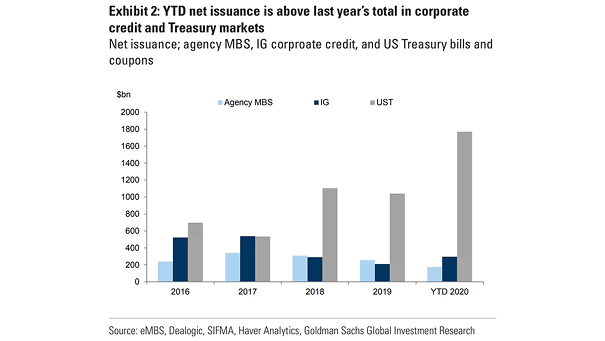

Net Issuance – Agency MBS, IG Corporate Credit, and U.S. Treasury Bills and Coupons

Net Issuance – Agency MBS, IG Corporate Credit, and U.S. Treasury Bills and Coupons March and April saw record paces of IG issuance. YTD total of net supply in IG is above last year’s number. Image: Goldman Sachs Global Investment Research