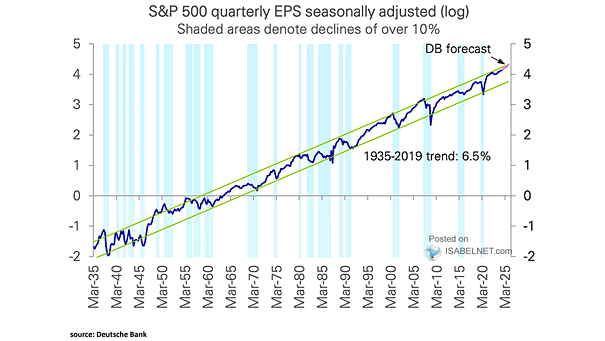

S&P 500 EPS and Long-Term Trend in Earnings

S&P 500 EPS and Long-Term Trend in Earnings While political and tax policy changes can have short-term effects, the overall trajectory of U.S. corporate profitability remains largely unaffected in the long run. Image: Deutsche Bank Asset Allocation