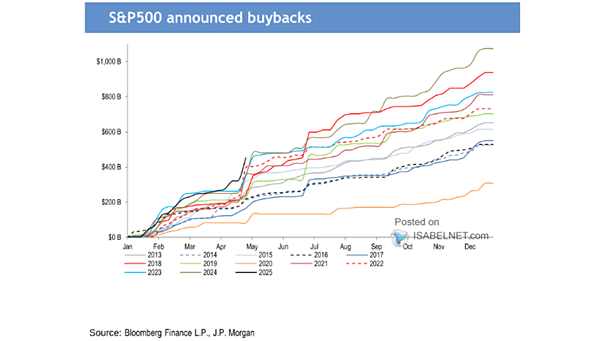

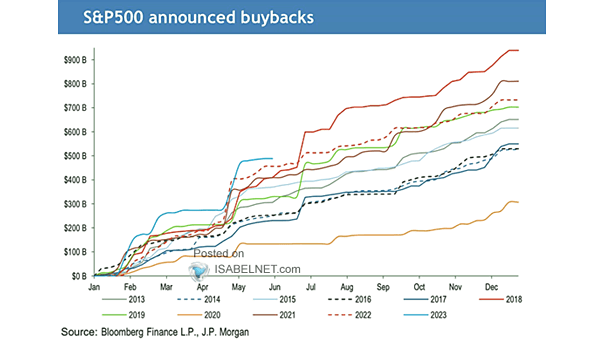

Buybacks – Announced Share Repurchases for S&P 500 Companies

Buybacks – Announced Share Repurchases for S&P 500 Companies In 2025, U.S. companies are announcing record share buybacks, with repurchases projected to exceed $1 trillion—a move designed to boost stock prices, strengthen financial indicators, and instill confidence in investors. Image: J.P. Morgan