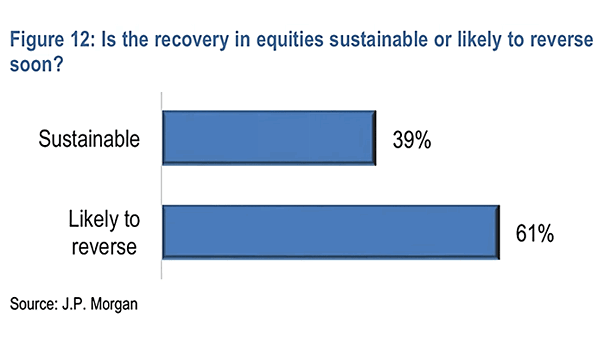

Is the Recovery in Equities Sustainable or Likely to Reverse Soon?

Is the Recovery in Equities Sustainable or Likely to Reverse Soon? A significant majority of JPM clients believe that the equity recovery will reverse soon, indicating caution and skepticism towards the sustainability of the current upward trend in equity prices. Image: J.P. Morgan