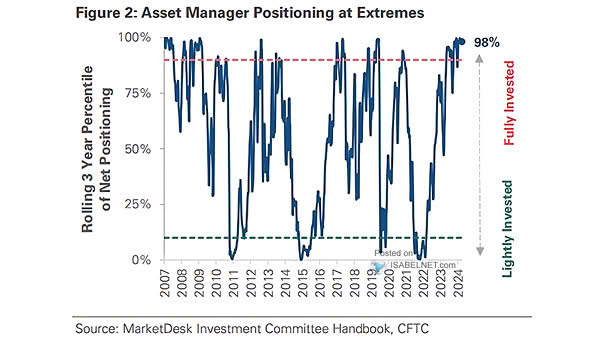

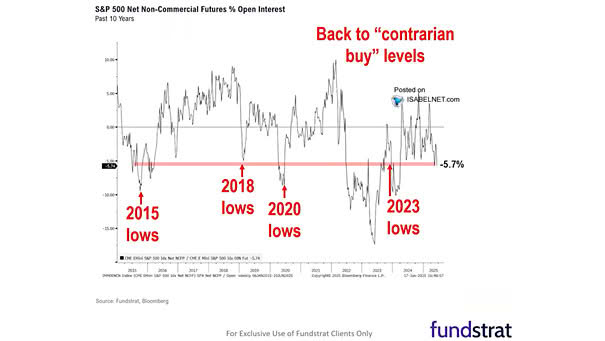

Positions in S&P 500 Equity Futures by Asset Managers

Positions in S&P 500 Equity Futures by Asset Managers Even with the recent rally and record highs in US equities, asset managers’ positions in U.S. equity futures are still lower than they were at the beginning of the year. Image: J.P. Morgan