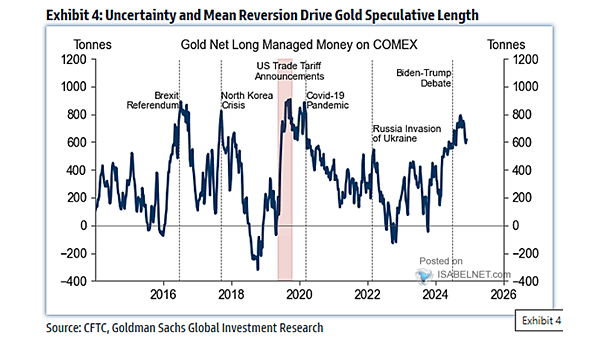

Managed Money Gold Futures Positions

Gold Net Long Managed Money on COMEX Gold’s appeal as a safe-haven asset historically strengthens during periods of uncertainty, leading to increased investor positioning. Image: Goldman Sachs Global Investment Research