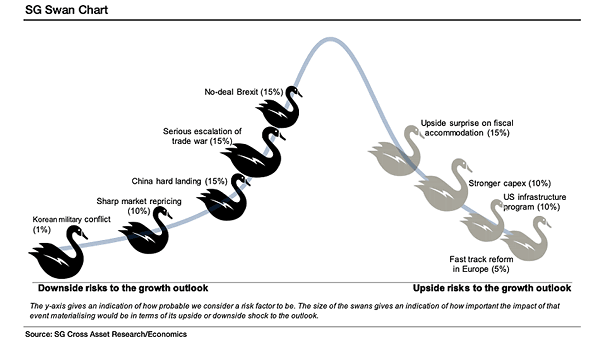

Upside and Downside Risks to the Growth Outlook – SG White & Black Swan Chart

Upside and Downside Risks to the Growth Outlook – SG White & Black Swan Chart The SG swan chart shows upside and downside risks to growth forecasts on a one-year horizon. Image: Societe Generale Cross Asset Research