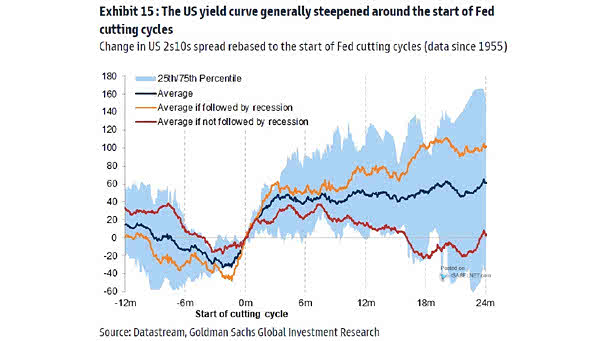

10-Year/2-Year Treasury Yield Curve Around First Fed Rate Cuts

10-Year/2-Year Treasury Yield Curve Around First Fed Rate Cuts The U.S. yield curve typically steepens once the prospect of interest rate cuts by the Fed becomes more imminent, rather than when the Fed actually stops hiking rates. Image: Goldman Sachs Global Investment Research