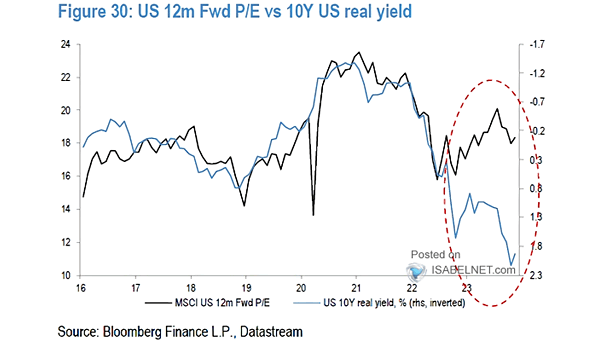

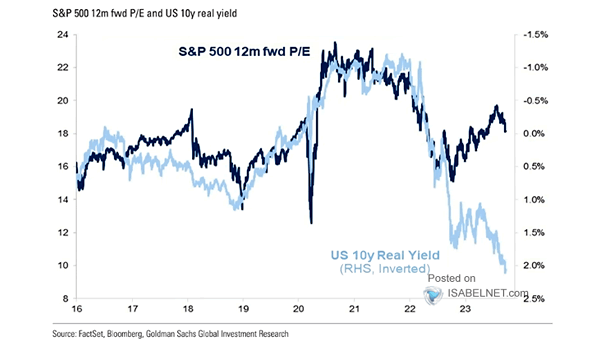

Valuation – MSCI U.S. Forward 12-Month Price/Earnings Ratio vs. 10-Year U.S. Treasury Real Yield

Valuation – MSCI U.S. Forward 12-Month Price/Earnings Ratio vs. 10-Year U.S. Treasury Real Yield While rising real yields have historically been associated with a decrease in stock market performance, the U.S. equity market has showcased its resilience by delivering impressive returns this year. Image: Morgan Stanley Wealth Management