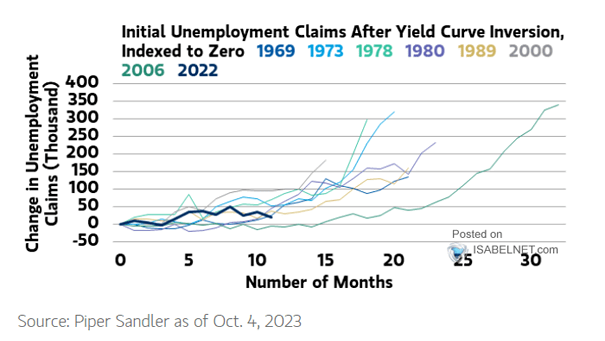

U.S. Initial Unemployment Claims After Yield Curve Inversion

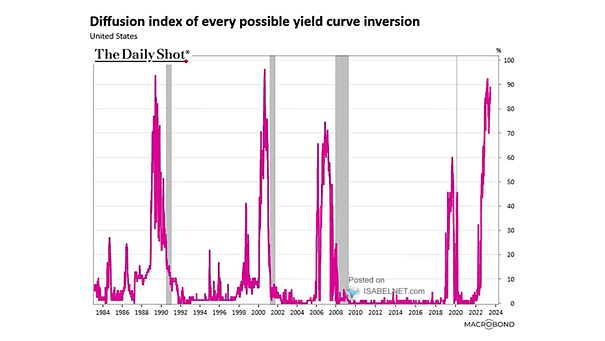

U.S. Initial Unemployment Claims After Yield Curve Inversion Is there a difference this time in the association between an inverted yield curve, usually indicating economic decline, and the potential for job losses? Image: Morgan Stanley Wealth Management