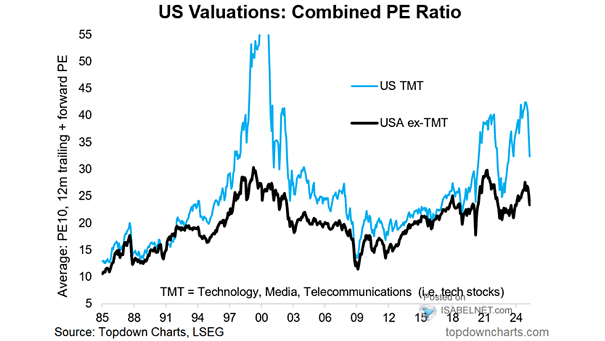

U.S. Stockmarket Valuations – Combined PE Ratio

U.S. Stockmarket Valuations – Combined PE Ratio U.S. tech stocks are viewed as expensive relative to the broader market. Although the rest of the market is not as pricey as tech stocks, it is still not considered cheap. Image: Topdown Charts