Apr

21

2019

Off

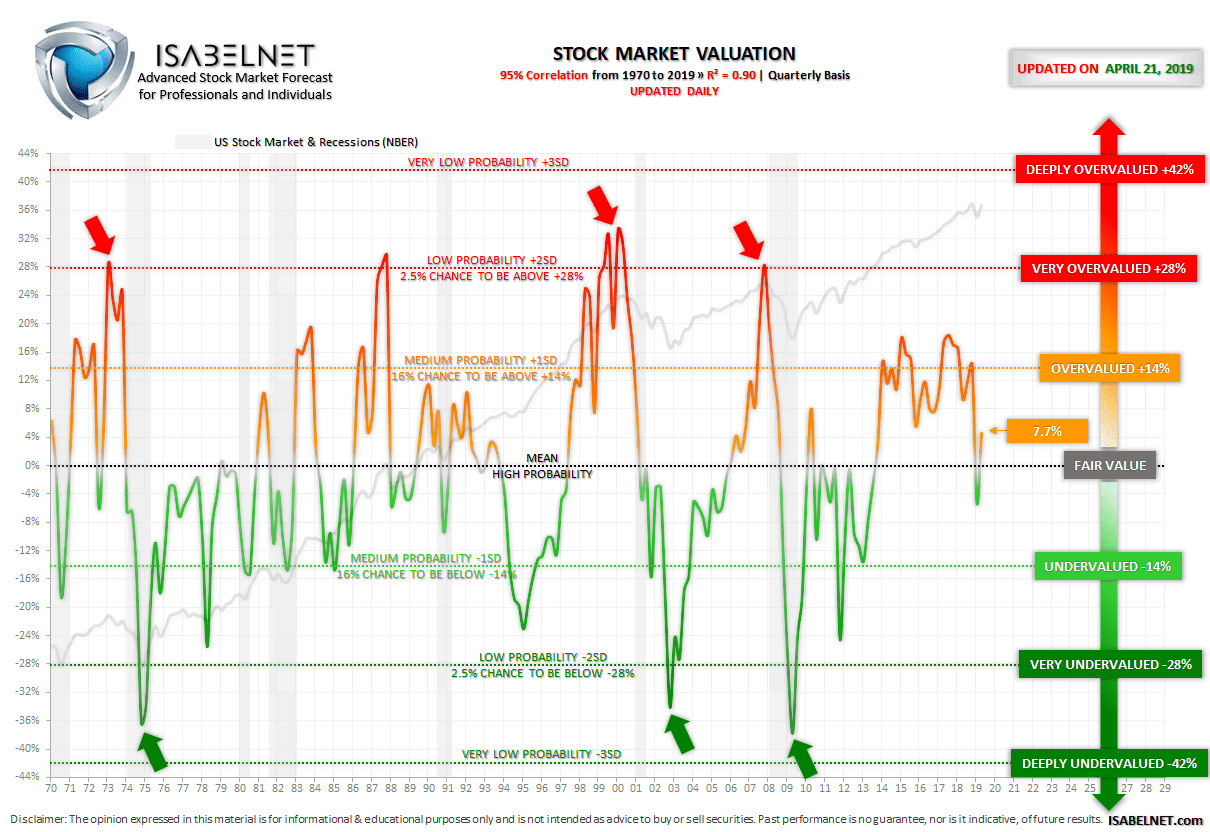

Why the Stock Market Valuation Matters Before a Recession?

When the stock market is VERY overvalued before a recession, it tends to be VERY undervalued. Like the swing of a pendulum, or the stretching of a rubber band, sooner or later it comes back very violently. This happened in 1973, 2000 and 2008.

The US stock market valuation is available to our subscribers. This great valuation model is updated daily. It has a 95% correlation with the US stock market on a quarterly basis since 1970 and an R² of 0.90.