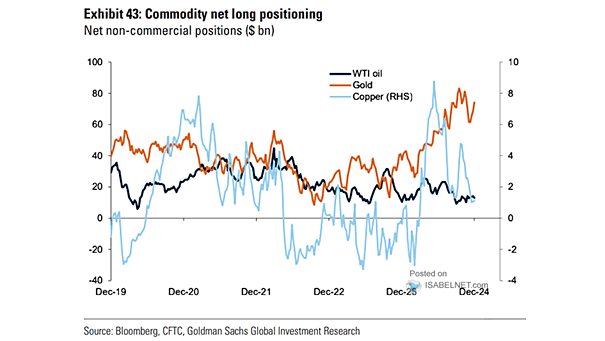

Commodities (Oil, Gold, Copper) – Commodity Net Long Positioning

Commodities (Oil, Gold, Copper) – Commodity Net Long Positioning While there are some pressures from rising U.S. Treasury yields and a stronger U.S. dollar, the current landscape for gold positioning is marked by a robust bullish sentiment, with increasing net long positions. Image: Goldman Sachs Global Investment Research