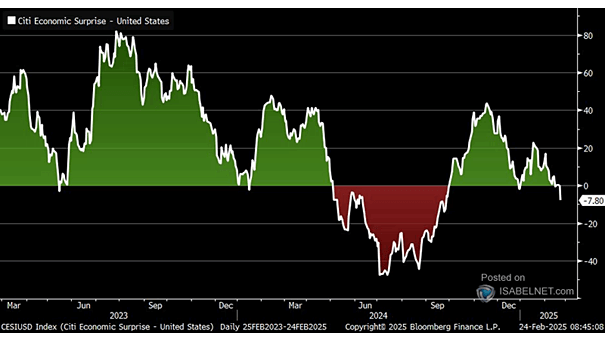

Citi Economic Surprise Index vs. 10-Year U.S. Treasury Yield

Citi Economic Surprise Index vs. 10-Year U.S. Treasury Yield Economic momentum-reflected in growth data and surprises relative to forecasts-continues to be the main force driving U.S. Treasury yields. Image: Paulsen Perspectives